Content Providers in In-Car Infotainments

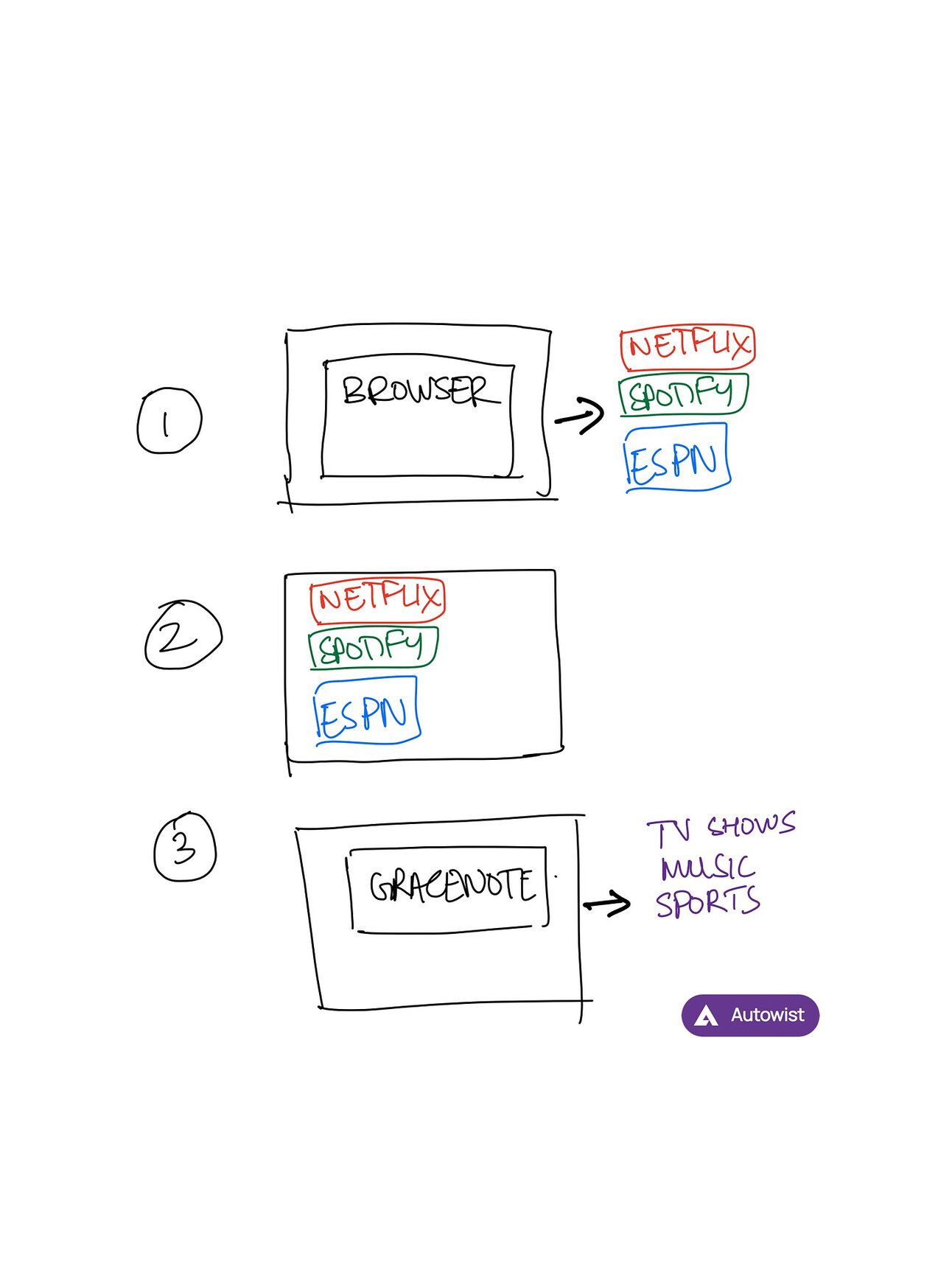

When it comes to hosting 3rd party content providers in an in-car infotainment, I see 3 approaches:

Browser-based: In this solution, 3rd party services are accessed through a browser based interface. Browsers provide a sufficiently well-defined sandbox and interface.

Native Apps: In the second approach, and them ore common one in newest vehicles. The infotainment is more closer to a smartphone where you can actually download the apps of these services directly onto the HW in the your vehicle.

Content Provider Partner: This is more akin to what we are familiar in in-flight infotainment systems. We have a content provider who has accumulated the most popular shows and is providing that as a complete portfolio of content to be shown in vehicle. No middleman, content first.

Recently, Gracenote announces its new automotive data platform, Nexus Auto, designed to enhance in-car media experiences. Compatible with Android Automotive OS and other operating systems, Nexus Auto offers easy integration for automakers, reducing development time. Data is there moat. They have tons of data from already existing vehicles that use Gracenote's and from other branches of their business. They could very well use this data to offer better discovery and recommendations.

For example, Champions League soccer followers can receive timely match updates when their favorite clubs are playing along with prompts to stream games if parked. “Suits” watchers can binge episodes during an E/V charging session or while waiting for their children’s soccer practice to end and get personalized recommendations for new shows or movies to add to their watchlists. Fans of BTS can blast their favorite tracks on leading music streaming services based on what’s playing on the radio. With the implementation of Nexus Auto, a wide range of new interconnected entertainment experiences open up in the car for consumers.

One shift in the offering compared to older systems like these is that now they are offering the platform as the skeleton allowing OEMs to build the user experience they want on top of this. I believe this will be a welcome change.

LG is taking a different approach. They announced a partnership with Netflix by integrating Netflix's streaming experience into webOS for Automotive, LG's automotive content platform. This move is a continuation of the partnership between LG and Netflix that began in 2011, initially focusing on LG’s television business. The integration aims to offer streaming performance and quality on par with LG's smart TVs, enhancing in-vehicle entertainment.

The strategy for webOS for Automotive involves enriching and expanding its in-vehicle entertainment offerings. LG plans to include a diverse range of entertainment service apps, encompassing sports, music, children's content, education, news, and games, transforming vehicles into extensions of living spaces.

The implementation of the Netflix app in webOS for Automotive has started in South Korea, first in updated models from Genesis, Hyundai Motor Company’s luxury vehicle division. This rollout marks a significant step in LG's strategy to improve and diversify in-vehicle entertainment options.

Gracenote’s new data platform lets automakers customize infotainment offerings (Link)LG reveals native Netflix app for its webOS IVI content platform (Link)

Next step in the Automotive Value Chain

The concept of purpose-built vehicles using OEM platforms as a base is emerging as a significant next step in the automotive value chain. This approach involves using the foundational elements provided by OEMs - like chassis, drivetrains, and basic electronic systems - and customizing them for specific applications and market needs.

Kodiak Robotics has developed a vehicle, the Kodiak Driver, designed for high-risk military operations without the need for onboard personnel, eliminating the risk of combat injuries. This prototype, which took six months to develop, uses the same autonomous system as Kodiak’s long-haul trucks and is based on a modified Ford F-150. The vehicle is equipped with DefensePods—protrusions fitted with radars, LiDARs, and cameras—allowing it to operate autonomously, though it can also be remotely controlled or manually operated.

Comma ai managed to create an ad-hoc HW+SW system that could be integrated into your vehicle to make it "autonomous". The system works for over 250+ models. The installation does require to tap into the wiring harness of the vehicle. But it does ensure that it can be done without any professional help.

Purpose-built vehicles are particularly suitable for niche markets where the demand is for specialized, high-quality products rather than mass-market appeal. These markets offer high margins due to the specialized nature and advanced technology of the products, despite their low volume. Military applications, like those demonstrated by Kodiak Robotics, are perfect examples of this, where the demand is for vehicles equipped with advanced autonomous systems and rugged capabilities, tailored to specific defense needs.

I see a trend that new players, could capitalize on the tail end of the value chain and this is just the beginning.

Kodiak Robotics develops an autonomous Ford F-150 for the Defense Department (Link)

OEMs adapting to make EVs more affordable

The automotive industry is rapidly adapting to the challenge posed by affordable Chinese electric vehicles (EVs), prompting legacy automakers to focus on cost reduction and efficiency. Companies like Renault, Stellantis, Volkswagen, and Tesla are aiming to slash EV production costs to compete with cheaper models. Innovations in battery technology and materials, such as using ferrite instead of rare earths for EV motors and integrating silicon nanowires into batteries, are key strategies. Automakers are also leveraging software and manufacturing innovations to reduce costs and improve performance, with a strong emphasis on simplifying production processes and enhancing vehicle affordability.

Volkswagen and Tesla are developing 25,000-euro EVs.

Stellantis is building a European plant with China's CATL to make cheaper LFP batteries and recently unveiled the Citroen electric e-C3 SUV, which starts at 23,300 euros ($24,540).

Renault said last month it plans 40% cost reductions for its EVs to reach price parity with fossil-fuel models.

GM said it has saved billions partly by developing a more inexpensive battery pack with LFP batteries for its revamped Bolt EV, which will launch in 2025, two years earlier than planned.

Ford said it will cut costs partly through a 50% increase in "in-sourcing" of parts like batteries and inverters.

Automakers race to reduce battery costs to compete with Chinese companies (Link)

Tesla Holiday Update

Tesla is releasing new features as part of its holiday update. And it is quite impressive how much features they are able to add to the vehicle just with SW updates alone. Having all the Hardware in place at the time of sale would mean an "over priced" or "over engineered" vehicle on paper. But in due time, it all makes sense.

Adding Apple Podcasts & Speed Cameras on Route: No additional hardware required. Needed an update in the Map Engine they use or they are building with additional data to include speed cameras. Adding apple podcasts, would mean that they had to do this in some kind of partnership with Apple.

Blindspot Indicators & High Fidelity Park Assist: Again, no additional hardware. For the blindspot indicator functionality, they had all the data coming in from their FSD hardware so it was a matter of SW development and testing. The high fidelity park assist, offers a 3d reconstruction of the vehicle in the surrounding. For a computer capable of "full self driving", both tasks are relatively easier task in terms of computation and memory.

Emergency Call: The car would call 911 in case of an emergency. Most OEMs have separate ECU hardware dedicated for this functionality. In many cases, mandated by legislation.

Light Show and Goat Noises: Easter egg like features are also part of this holiday update, in true Tesla fashion.

Other updates

Tesla App Trip Planner

Rear Screen BT Headsets

Rear Screen LAN gaming

More Live Sentry Cameras

Tesla update coming next week adds useful features, and an annoying one (Link)

Auto Parts meet Data-enabled distribution

“Mtor” is an Egyptian startup that has raised $2.8 million in pre-seed funding for its online auto parts marketplace. The startup aims to provide a platform for car owners and mechanics to purchase auto parts online, with a focus on the Egyptian market. The platform will offer a wide range of auto parts, including original equipment manufacturer (OEM) parts, aftermarket parts, and used parts.

Here are the intersting bits:

Mtor uses data to better price and provide parts information to its customers

They want to focus of B2B. Companies that have a fleet of vehicles for its operations and providing maintenance services to them.

Process and operation optimization enabling them to undercut parts directly from the OEM, which is usually priced in multiples.

Aging fleet of 8 million vehicles and an average spend of 600$ annually for workshop and other service providers means that there is a growing market for such a service

Egypt’s Mtor nabs $2.8M pre-seed for its online auto parts marketplace (Link)