How Rivian reduced electrical wiring by 1.6 miles and 44 pounds (Link)

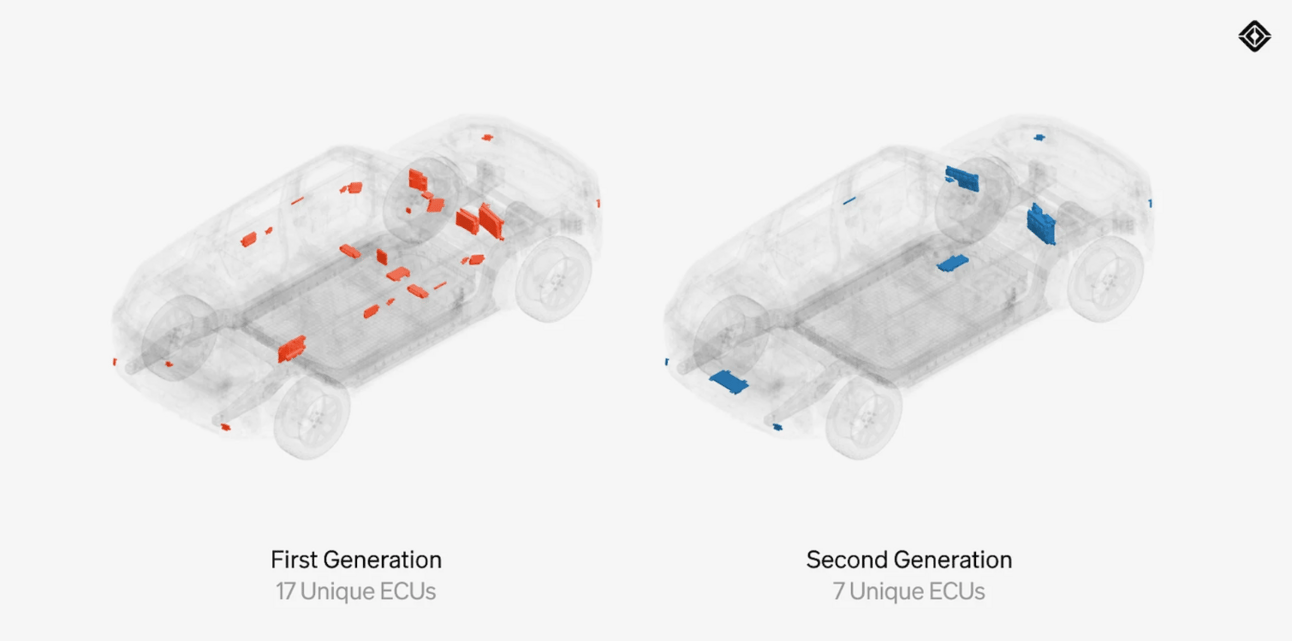

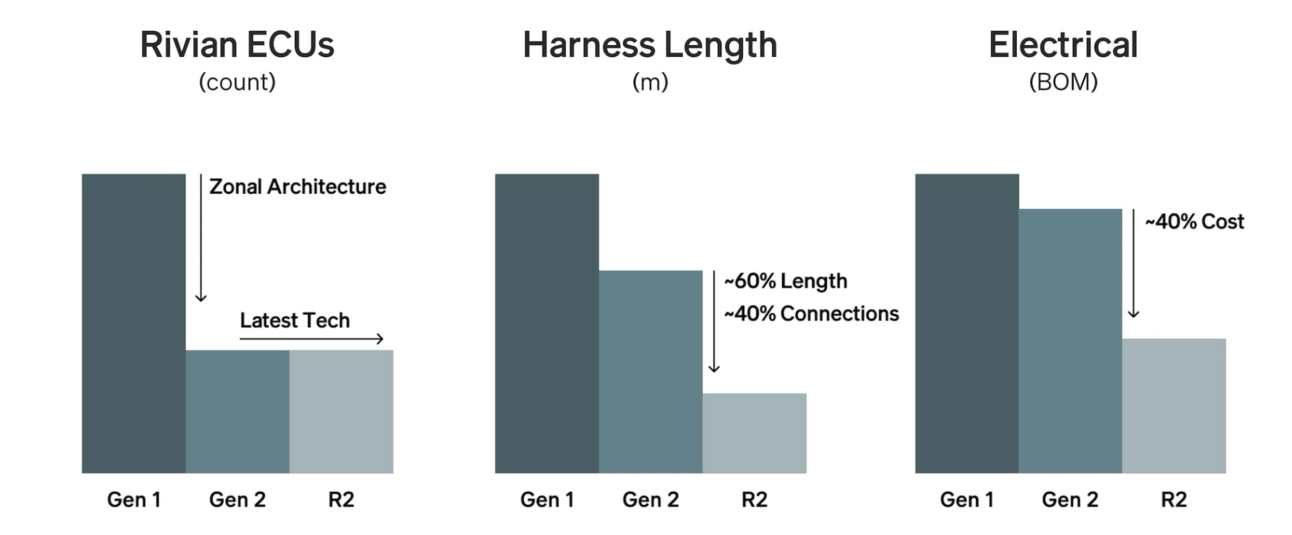

Rivian introduced a zonal architecture for its electrical hardware with the release of our second generation R1 vehicles in June 2024. This allowed Rivian to reduce the number of electrical control units (ECUs) on its second-generation R1 vehicle from 17 to just 7 and to remove 1.6 miles of wiring from each vehicle.

Here's my understanding of how they managed to do this and where legacy OEMs are lacking:

Consolidation of functionality in a fewer ECUs: Consolidating functions is a tricky subject to deal with organizationally. Legacy OEMs are stuck in years of reinforcing Conway's law, that consolidating ECUs has become so hard.

From a technical point of view, consolidating is a high-leverage move only if the right functionality and end-effectors are coupled together. A deep analysis of the needs on the platform level towards the customer needs to be done before deciding what should be merged together. I can easily see scenarios where the wrong things coupled, ends up creating ugly dependencies all over the vehicle architecture.

Another aspect to consolidation of functionality is that complexity increases over time as more and more functionality is added to the platform. And engineers are stubborn to "re-wire" the architecture with the addition of new features. Instead it ends up with multiple work around solutions and "hacks" to get everything to work together.

In-house developed software platform counter-acts the inertia to move quickly, provided best practices are followed. All else being equal, an in-house system will mature and optimize faster than any externally bought system. This kind of speed and in-house competence is an enabler to allow architectural optimization.

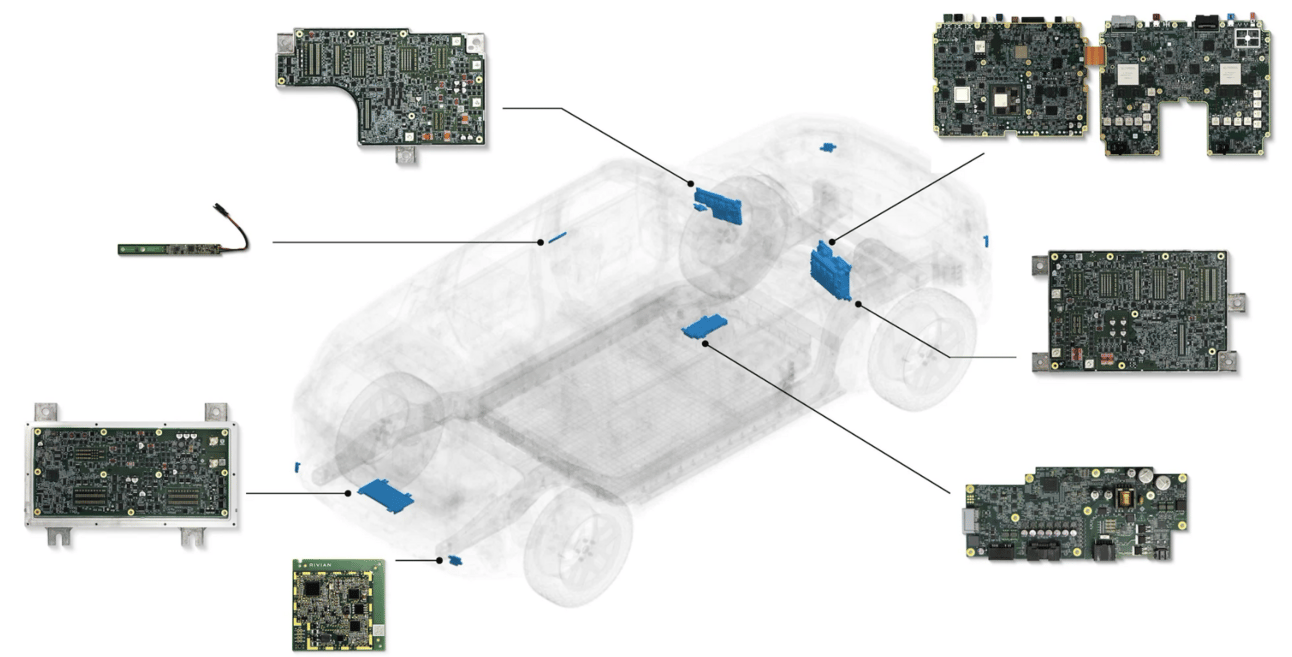

In-house developed ECUs in Rivian

The China Strategy Problem (Link)

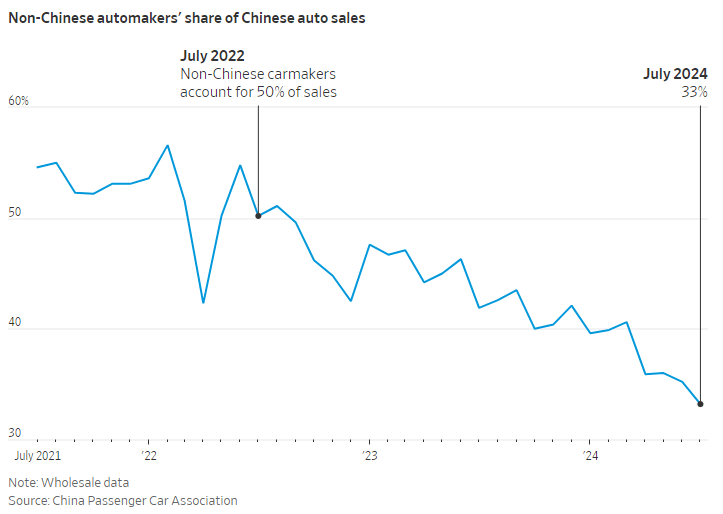

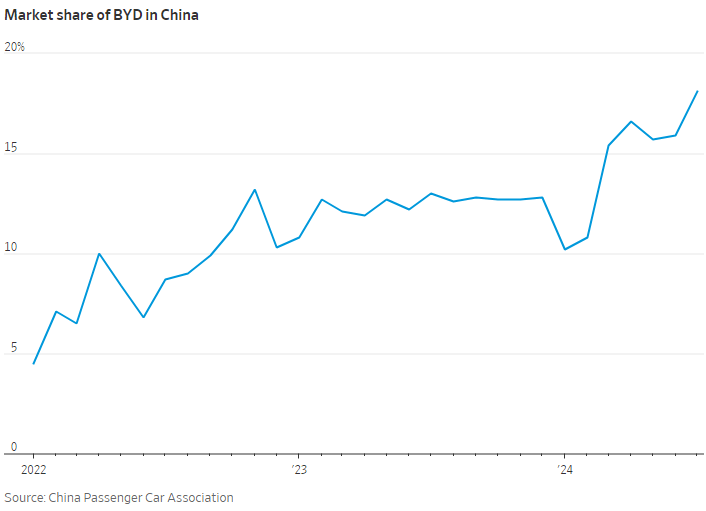

As of July 2024, non-Chinese carmakers' share of the Chinese auto market has dropped to 33%, down from 50% two years earlier. This decline is largely due to the rising dominance of domestic electric vehicle (EV) brands like BYD, which has become China's top-selling carmaker.

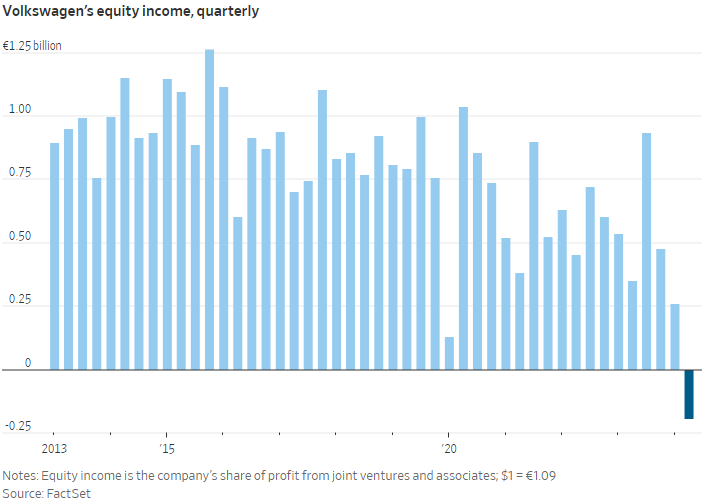

Volkswagen, a key player in the Chinese market, reported its first quarterly loss in at least 15 years from its Chinese joint ventures, signaling the challenges faced by foreign automakers. Similarly, General Motors (GM), which once sold over four million vehicles annually in China, has seen its sales almost halve by 2023 and has reported consecutive quarterly losses in 2024.

Tesla, despite its unique position with a wholly-owned factory in Shanghai, has also seen its revenue share from China decline, while other Asian manufacturers like Toyota and Honda have experienced significant drops in their Chinese joint venture incomes.

What is actually going on?

Have OEMs miscalculated the market? Was their strategy more relying on "Build and they will come".

Chinese OEMs have been in a better position to anticipate the market needs.

Government subsidies for sure have played a role in accelerating the development. In addition to that, the current government policy makes it very hard to have an own foreign based venture in China, which means most of the local OEMs have partnered with foreign OEMs in joint ventures. In a way, the government is subsidizing on both side, on the consumer side and on the market competition side. For Chinese OEMs, they get to piggyback on years of development from foreign OEMs. (Link)

A second order effect is that the talent in the automotive space in China gets a real boost in up skilling themselves.

Chinese OEMs enjoy a certain degree of supply chain consolidation that foreign OEMs are struggling to reach, simply because of the proximity they have to their suppliers.

From this qualitative assessment, except for brand image related factors, dealer network and service network the Chinese OEMs have an edge over OEMs from other parts of the world.

Meanwhile Xpeng is actively looking for sites in the EU (Link)

Summary: In response to the EU's temporary tariffs on imported Chinese electric vehicles (EVs), Xpeng is advancing plans to establish a production plant in Europe to mitigate the impact of these tariffs. This decision follows the company's participation in the European Commission's investigation into subsidies received by Chinese EV producers. Although Xpeng wasn't individually sampled, it faces a tariff increase from 20.8% to 21.3%, effective by November.

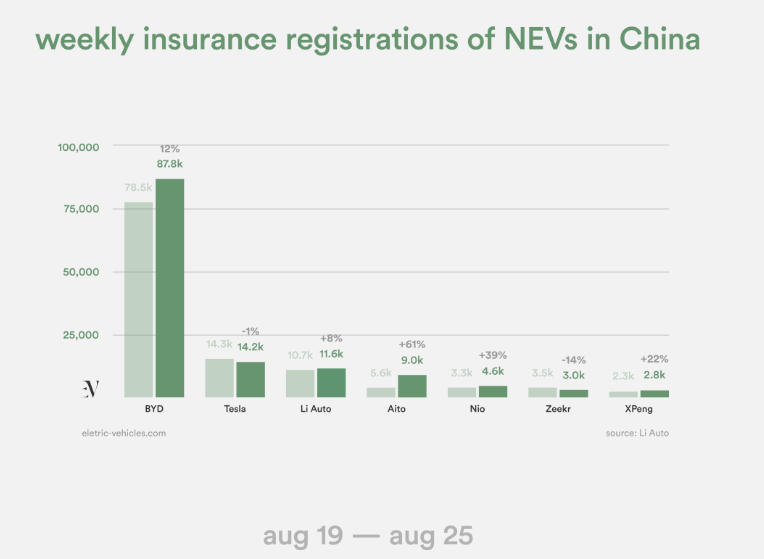

Chinese NEV vehicle registrations for insurance in the last week(Link)

China’s weekly insurance registrations were released on Tuesday revealing that BYD reached a new record of 87,800 new energy vehicles (NEVs) insured — up 12% from the previous week. The figures cover the period between August 19 to 25 with the NEV penetration rate in China surpassing the 50% milestone again.

BYD delivered 342,383 new energy vehicles (NEVs) last month, up 30% year-over-year (YoY) and surpassing its previous record of 341,658 NEVs. The company also delivered 130,000 battery electric vehicles (BEVs) during the month.

Tesla followed with 14,200 units — a slight decline of 100 vehicles week over week — as the company extends the 0% interest loan program by another month until the end of the third quarter.

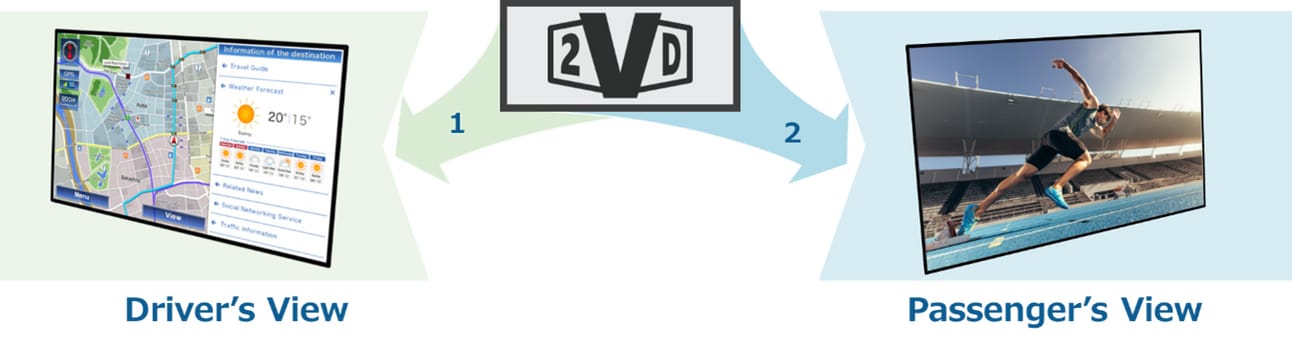

New Tech Alert: Dual View Displays

Summary: Japan Display Inc. (JDI) has developed the world's first automotive-grade 2 Vision Display (2VD) technology, which simultaneously displays different content to the driver and passenger on a single screen while offering dual touch capabilities. This breakthrough allows the display to function as two separate touch-enabled screens, resolving previous image quality and touch functionality challenges that hindered commercialization.

JDI's Dual Touch 2VD technology uses custom ICs to differentiate touch inputs from the driver and passenger, making it ideal for automotive use. It also supports innovative applications beyond the automotive industry, such as large signage, display security, and gaming. JDI is currently in discussions with global automobile manufacturers to incorporate this technology into next-generation vehicles, with potential deployment as early as 2025.

Dual view is a neat way for sure to integrate the views for the driver and the passenger in a single display. Here are my thoughts:

The main hinderance to this being used in automotive in the past as the article suggests was the resolution, brightness and similar properties were not good enough for close viewing and interacting.

The concept around such displays to ensure some level of safety in the product will be a challenge, especially considering varying viewing angles that can lead to hazardous situations. Most probably OEMs would have to not allow such features on these displays.

Is this actually adding customer value? Is there a use-case in which the center display is needed to be used by both the driver and the passenger, to the extent that it is causing annoyance to the users. And if not eliminating annoyance, is this a feature that can provide some delight to users. I am still skeptical of it's automotive applications, mainly as an infotainment display.

BMW overtakes rival Tesla to take the top spot in European EV sales (Link)

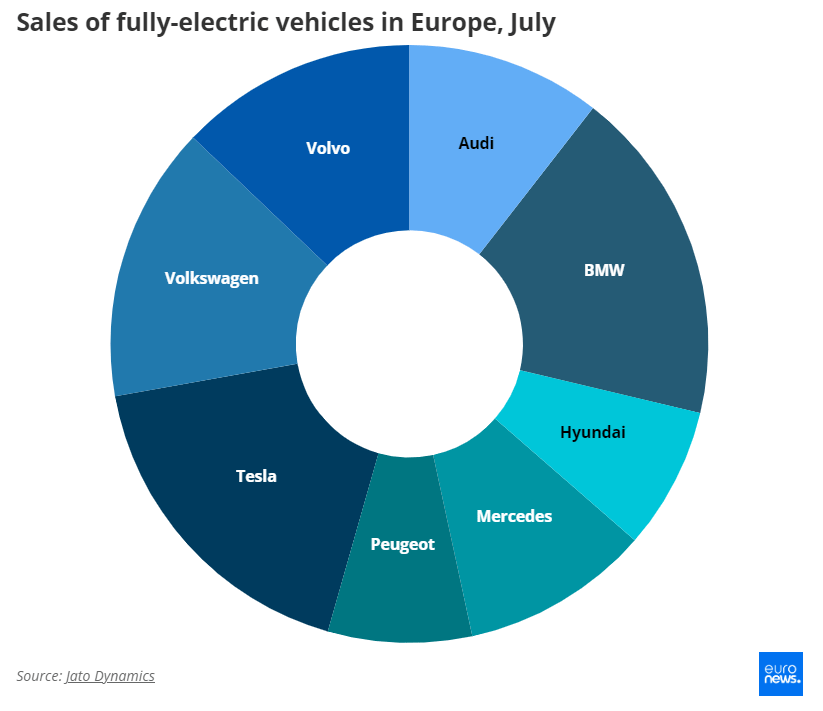

Sales of fully electric BMWs rose by more than a third in July, although the German carmaker still trails behind Tesla in year-to-date sales. BMW dominated the European electric vehicle market for the first time in July, registering a surge in demand while other competitors struggled. The German carmaker sold 14,869 fully electric cars in July, according to research firm Jato Dynamics - a 35% year-on-year increase. Tesla, meanwhile, sold 14,561 EVs, a 16% yearly decline.

A look into Lamborghini Investor Slide Deck (Link)

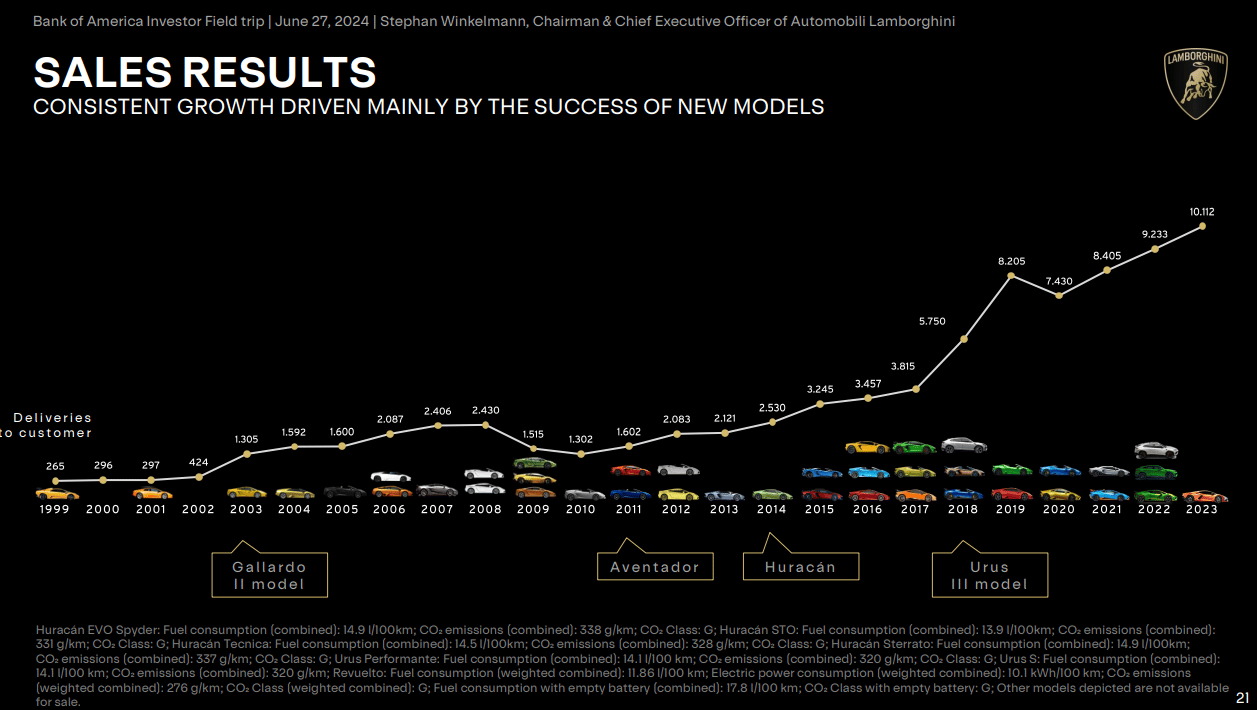

There are only 2 dips in the growth trend. The first during the 2008 recession and the second during Covid-19.

I believe to see Lamborghini to be at the sweet spot of Volume vs. High-end cars. To be not very susceptible to market forces you need to be just at the right volume but at the same time be high-end enough(either from a luxury point of view or from a sports point of view)

The sales are around a 10k per year, while the latest headcount sits comfortably at 2,608.

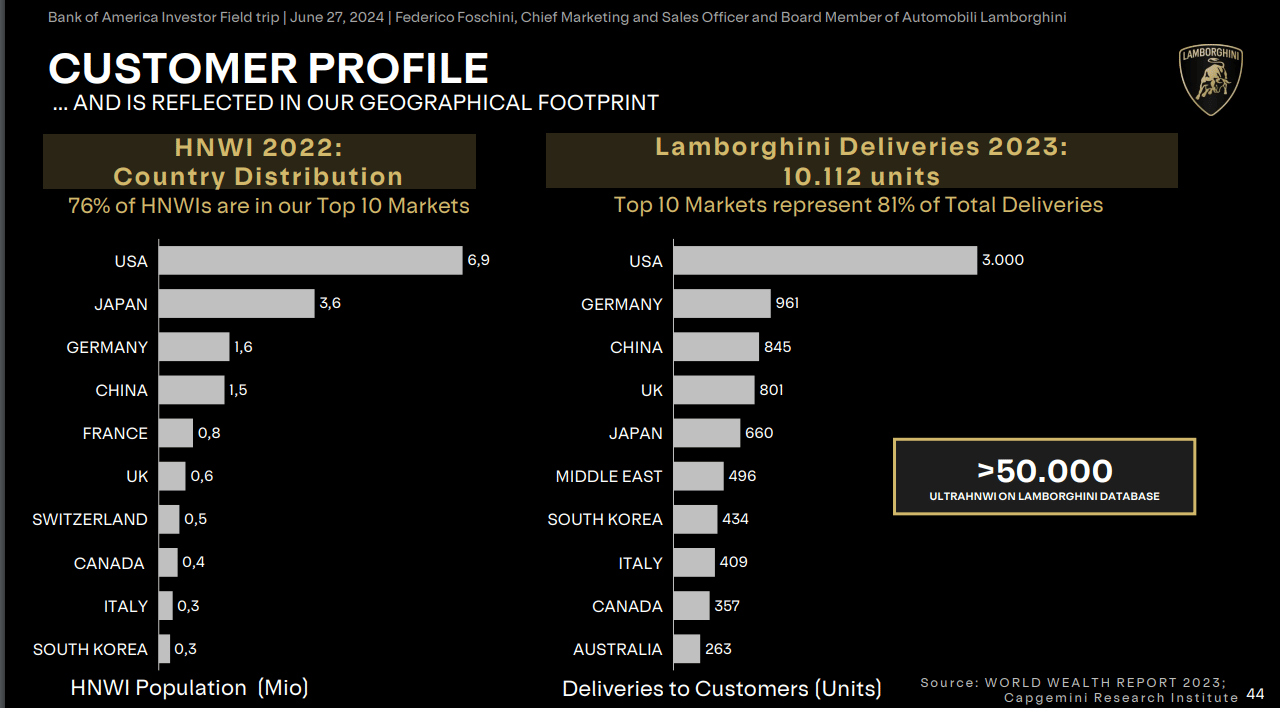

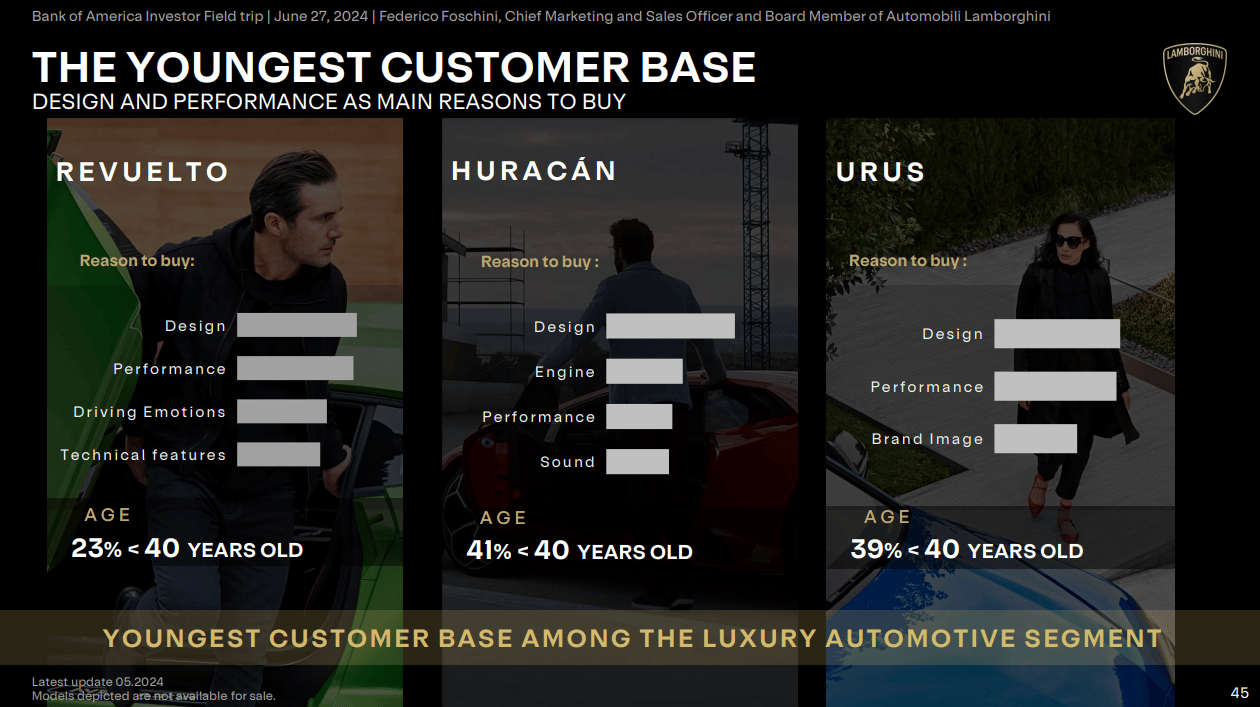

The customer age groups for all the 3 active models falls majorly on the >40 year old category. And they are clear with targeting the high net worth part of the market.

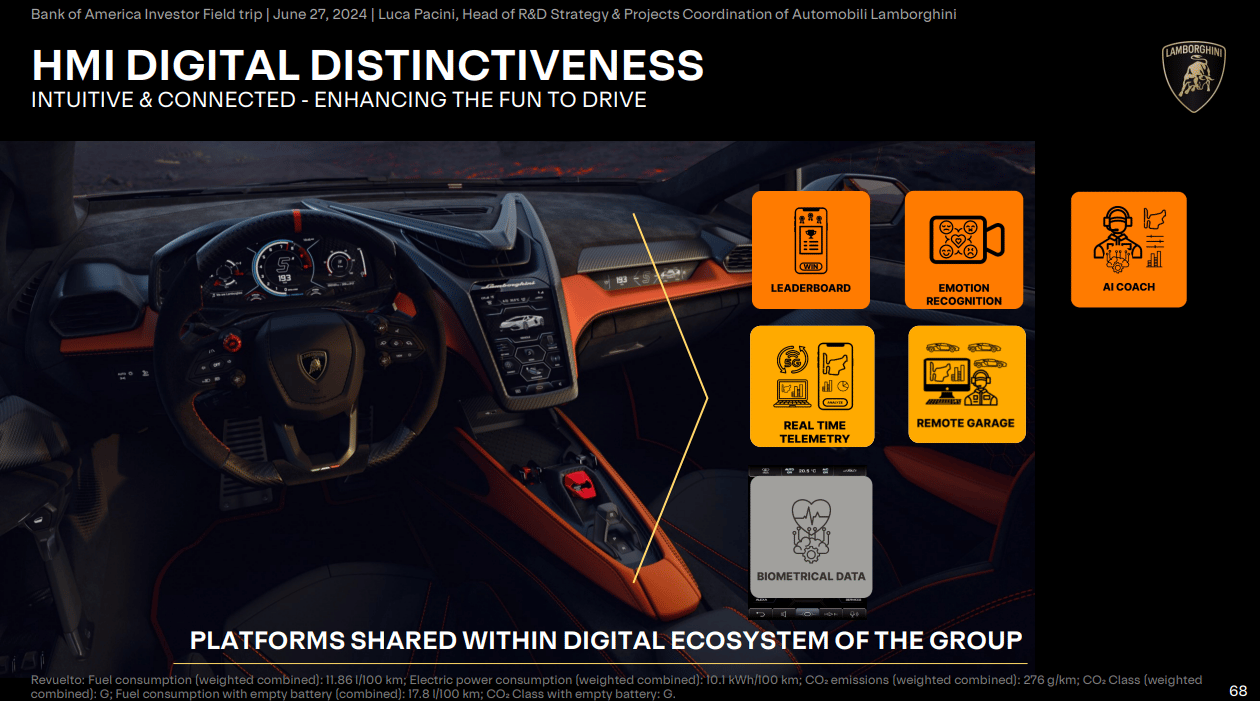

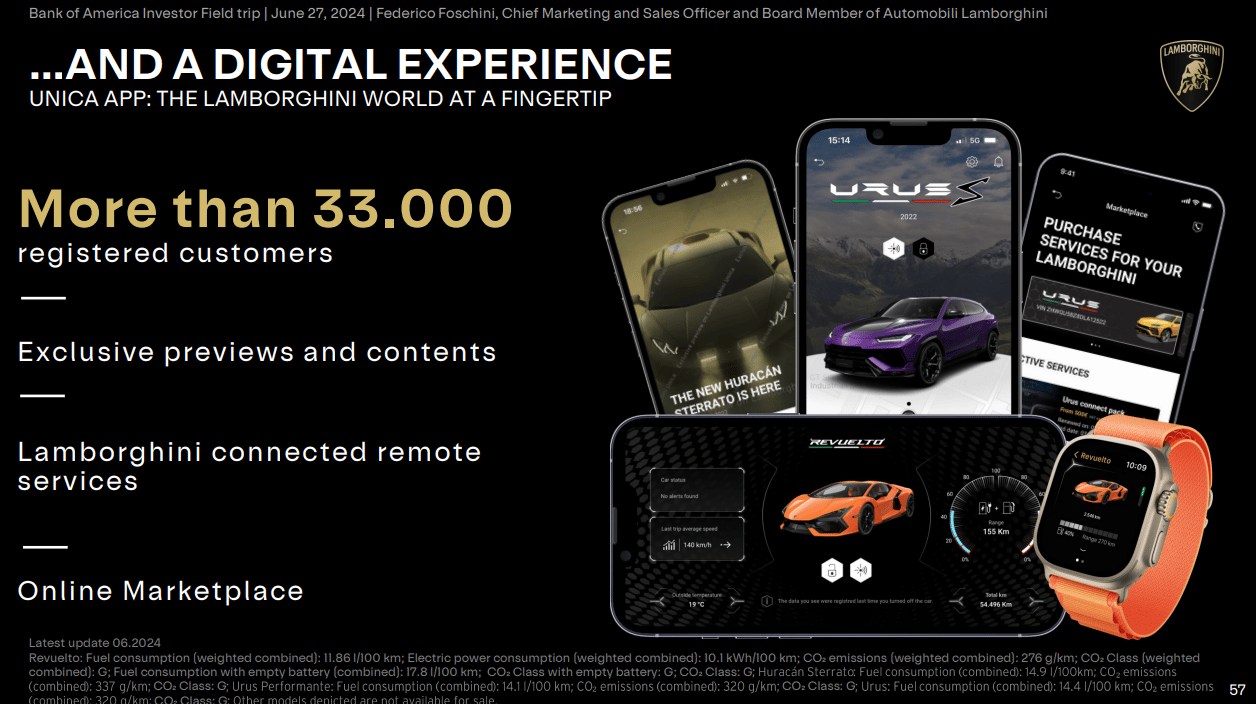

Lamborghini has an ecosystem approach to the digital experience they offer both in and out of the vehicle.

Real time telemetry is a very racing-oriented feature that is so unique to brands like Lamborghini.

Gamification of the driving experience and a leaderboard to compare your times with fellow Lamborghini users.

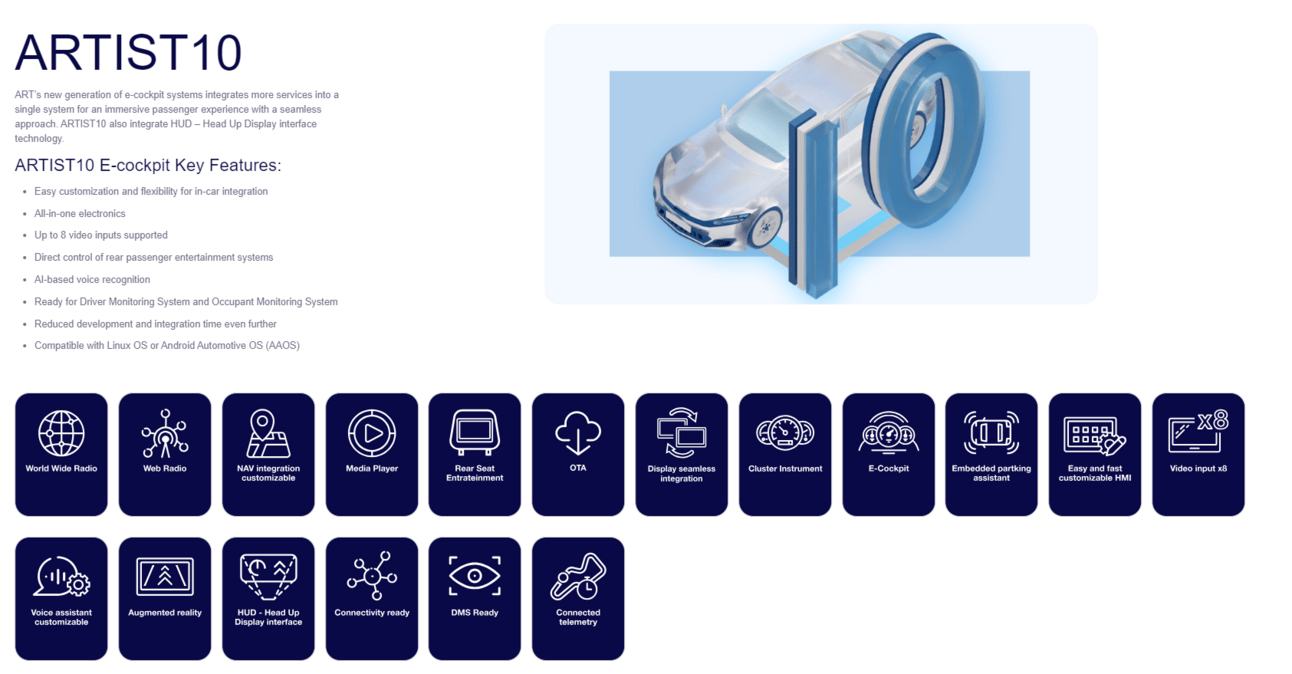

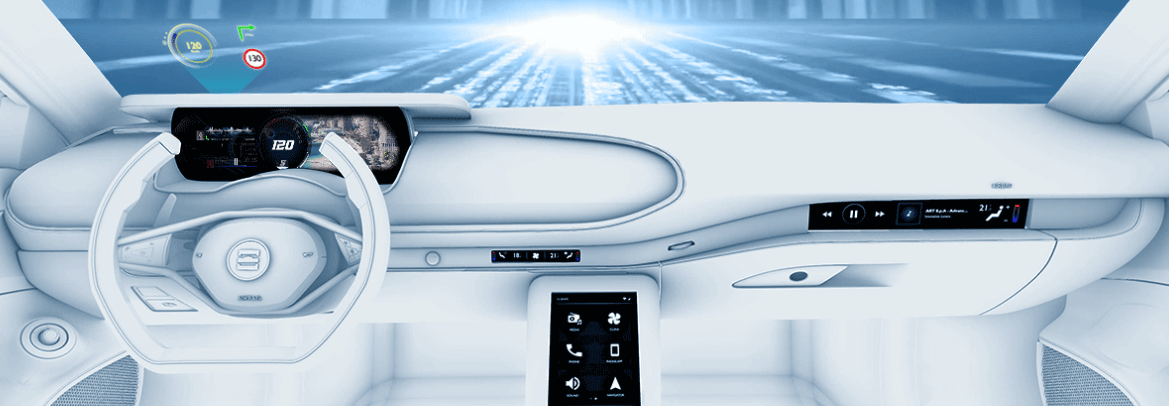

The Lamborghini infotainment system is supplied by ART Group. Headquartered in Umbria, Italy.

By looking at the pictures it is quite evident that the system is exactly how it is in a Lamborghini vehicle

Telemetry X

Telemetry X is three technologies brought together as a prototype system presented in Lamborghini’s new 1,001 hp Revuelto. The first piece is called Remote Garage, which uses the car’s integrated 5G wireless connection to beam telemetry and high-definition video from the vehicle straight to a driver coach.

The second part of Telemetry X is called the Biometric Data System, which layers in details about the driver’s health, including heart rate and supposed stress level, providing another aspect to the potential training feedback.

All of that works in concert with the Digital Co-Pilot, a next-generation, artificially intelligent voice assistant that can provide real-time guidance to enhance your on-track performance, and is able to call you out if you’re too late on the brakes or slow through the apex. Think Alexa meets Mario Andretti, and you’re not far off.

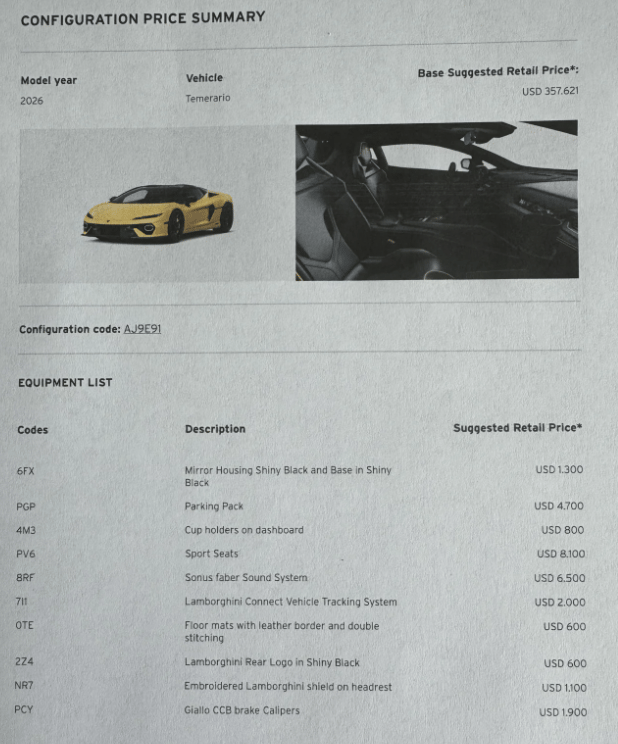

In one of the Lamborghini forums around the internet, I came across a build submission for a Lamborghini Temerario. The model year for this order is 2026.

Some customer options and prices that I would like to point out

Cup holders on the dashboard that cost 800USD. Ouch!

Alleggerita Package: Reduces weight by up to 55 pounds with carbon fiber components.

Comparison with Huracan: Prices align with Huracan's options, indicating similar personalization cost